The last time I looked, Portuguese wages were the lowest in Western Europe. So says the official Eurostat data:

But the Bank of Portugal doesn’t reckon they are low enough

Why? Apparently ‘unit labour costs’ – the ratio of the cost of workers (including social security costs) per unit of output – have increased over the past three years or so, while in Spain, Ireland and the UK, they have fallen.

They need to come down by about 10%, the bank says. To restore competitiveness and growth, and, it can be read, to stave off another IMF-EU bail-out.

Forget that despite the upward trend, unit costs of Portuguese workers appear to be the cheapest in Europe according to Eurostat.

But as we are talking about a ratio, I’m guessing that in Germany and France historic and more recent investment has played a large part in delivering higher productivity, that is each workers producing more per head on average, and thus lower unit labour costs.

Cut wages or invest?

So another way of fixing the problem would be to encourage Portuguese businesses to spend on technology and training, and to innovate, in order to make each worker produce more and/or more valuable goods/services.

But that’s not under consideration. For one thing, despite all the zillions to the banks there’s still no credit. Banks aren’t lending. And as well as being starved of finance, businesses are also not investing because they can’t see, amid all this austerity and negative growth, any buyers for their products.

So the Bank of Portugal’s plan – pretty much like every other central banker and government in Europe – is to cut wages. One way this has already been pursued is through labour reforms, such as the package passed in March by Lisbon. By making it easier to hire and fire, it will weaken workers’ bargaining power and allow employers to drive down pay and benefits.

But, as in Spain and Italy where they’ve also passed slash and burn labour reforms, apparently that’s taking too long. Hence the fresh urge to take action, now.

Doesn’t work, won’t work

The thing is, it won’t work and recent history has shown this.

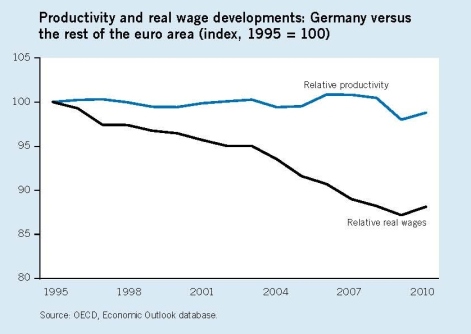

Germany led the way on wage deflation in the late 1990s through much of the noughties, thanks to its own labour reforms. It eventually got a boost to its economy as exports boomed but only after years of near stagnation (remember the headlines. Germany ‘sick man of Europe’ .)

Wages were held down so Germans curtailed their spending, leading to poorer corporate profits, and so less investment and so on in a downward spiral.

And when the growth came, through exports, (new headlines, Germany powerhouse of Europe) it was strictly as the expense of its neighbours, like Italy (a zombie economy for a decade), and yes, Portugal (although Chinese competition hadn’t something to do with its woes too).

Southern European countries who’d initially done pretty well as interest rates fell in the unified Eurozone, they became the new patients in Europe’s economic sick bay. (Germany, it is important to add, was also helped by the Euro that by incorporating weaker economies in southern Europe was weaker, in Germany, than the Deutchemark it replaced, cheapening exports)

Anyway, the only way southern Europe could respond in the short term was through through wage cuts too. Longer term greater investment could have raised productivity, if business was so inclined, although recent history shows that, left to their own devices as is the prevailing laissez faire way, they have shown scarce interest in doing so – evidence. Workers’ misery in one country was eventually spread across the Continent, a trend confirmed in recent data showing falling real wages.

But as is the nature of beggar thy neighbour policies that led to the Great Depression of the 1930s, in the end everyone loses. The whole European economy is now in a mess with most recent data showing it is sliding deeper into recession, Even the German powerhouse is slowing. This was perfectly predictable as as by making its neighbours poorer, the neighbours were left with no choice but to cut their spend on German imports. This was only mitigated for a period by households resorting to large amounts of debt (and we know where that ended up) Germany thus produced the conditions for its own downfall.

Now just suppose wages are cut in Portugal enough to restore competitiveness of Portuguese products. Who’s going to buy them? Nobody, because everybody’s in a recession that is ever deepening precisely because we are all pursuing the same policies of austerity. For all the talk of bringing Europe together, recent history suggests European integration has been a divisive game of dog eat dog.

So the Bank of Portugal recommendations are nonsensical, economically suicidal and if acted upon will be very painful to an already poorly paid workforce.

Solutions

To be sure the solution isn’t just to let wages rise. Europe’s growth model to date has been deeply flawed.

Mountains of private debt, unsustainable housing bubbles, billions handed over in contracts and public assets to privateers, widening gap between the very rich and everyone else. This must end.

We need more public and less private goods and services (more buses and trains, fewer cars, more affordable rented and social housing, less reliance on individual home ownership).

We need to move way from market-led chaos through proper, democratic planning that fosters new and job-creating industries, which takes into account the needs of society and the protection of the environment.

And we need to be thinking more about our local communities, producing for themselves, and less about the dividends and stock of shareholders of transnational corporations .

But that will take some time.

Right now Portuguese workers, the ones with a job (23% is the real rate of unemployment), and their colleagues across Europe, need a break.

The only incomes that need to be curtailed are the ones in six figures, of the bankers and the rest of the 1% whose greed and speculative gambles are at the heart of the west’s financial and economic crisis.

As for the rest of us, our meagre wage packets need to be fattened up again, so we can help spend, and afford to pay the taxes needed to restore our dying businesses, hospitals, schools and welfare services back to health.

Discussion

No comments yet.